US corporate bond market continues upward trajectory – The DESK

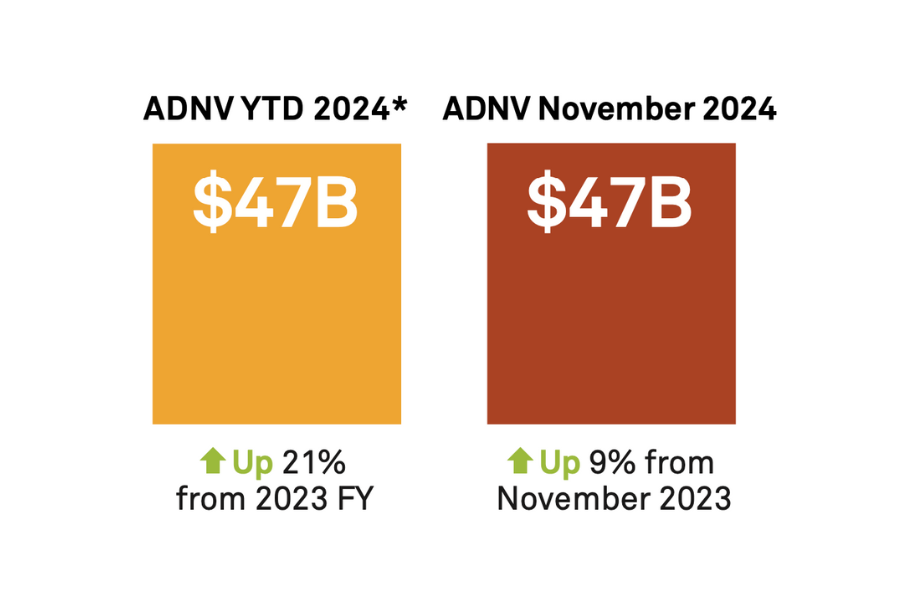

Average daily notional volumes (ADNV) were up 9% year-on-year (YoY) in US credit markets, reaching US$47 billion. Year-to-date, ADNV is up 21%.

In 2024, the percentage of this volume traded electronically has increased marginally YoY, up two percentage points to 43%.

Bạn đang xem: US corporate bond market continues upward trajectory – The DESK

In both high yield (HY) and investment grade (IG) US corporate bonds, liquidity has improved over the year. The MarketAxess Bid Ask Spread Index has dropped by 27% in HY bonds and by 15% in IG bonds YoY. Coalition Greenwich notes that this is not a direct result of increased overall and e-trading volumes, but states that these factors have brought more participants to the market.

Xem thêm : China’s Bond Market Is Signaling Worry Over a Decades-Long Downturn

Also impactful has been an increase in portfolio trading and a favourable macroeconomic backdrop for new issuance, the report adds.

As a result of improved bond market performances, ETF volumes decreased relative to market growth in November – by 16% YoY, according to Coalition Greenwich’s tracked funds. Similarly the ETF-to-cash ratio fell by 23% to 15.5% YoY. This was more pronounced in HY (10 percentage points) than IG (1.5 percentage points).

Dealer net positions in corporate bonds with durations of five years or longer ended the month short US$3.76 billion (up from October’s US$3.82 billion). By contrast, short duration corporate bond holdings remained flat from October at US$5.5 billion but were down 50% YoY.

Xem thêm : Trump’s tax plans could diminish municipal tax exemptions

“We expect to see some movement in these positions as banks prepare for year-end and a new fiscal and monetary policy environment in 2025,” the report concluded.

©Markets Media Europe 2024

Nguồn: https://linegraph.boats

Danh mục: News