Los Angeles Utility’s Municipal Bonds Drop Amid Destructive Wildfires

- Stock traders rattled by fresh rise in bond yields: Markets Wrap

- Israel Bonds Dinner Explores Healthcare After Oct. 7

- Soaring Bond Yields Risk Liz Truss Moment for Markets: Apollo Economist

- Indian Bond Issuance Strategy Gains Traction With Key Offerings

- Reeves back from China with one eye on bonds and the other on economic data | Economic policy

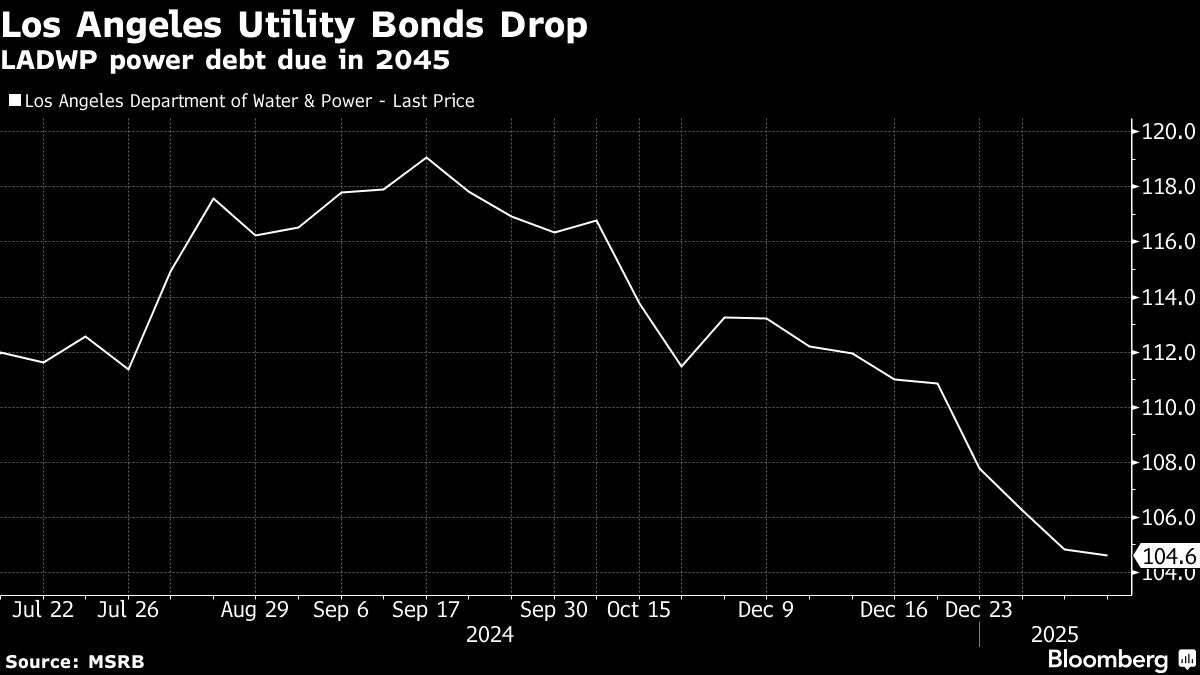

(Bloomberg) — Power revenue bonds sold by Los Angeles’s municipal utility dropped on Friday amid the devastating wildfires in Southern California.

Bạn đang xem: Los Angeles Utility’s Municipal Bonds Drop Amid Destructive Wildfires

Most Read from Bloomberg

Xem thêm : Global bond tantrum a wrenching and worrisome start to new year

Prices on municipal debt issued by the Los Angeles Department of Water and Power have declined this week. The average spread on debt due in 2045 widened to 112 basis points on Friday, up from as little as 95 basis points in December.

The scale of the destruction in America’s second-largest city is becoming clearer. At least 10,000 structures, including homes and businesses, have likely been damaged or destroyed as the blazes have burned about 30,000 acres, fire officials said.

The Los Angeles Department of Water and Power is the largest municipal water and power utility in the US, with 1.4 million electric customers. JPMorgan Chase & Co. strategists said the utility and other issuers “face headline and downgrade risk.”

Xem thêm : a Complete Guide to Tax-Free Investments

Analysts at S&P Global Ratings said in a report Thursday that the fires “might pose significant financial and operational risks for rated entities, especially if not-for-profit electric utilities’ infrastructure triggered the fires.”

Still, Bank of America Corp. strategists said in a Friday report that Los Angeles’s overall credit profile will remain resilient given that it’s the second-largest city in the US. Utilities can also adjust rates to support operations when necessary, they said.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Nguồn: https://linegraph.boats

Danh mục: News