Lebanon’s 187% Bond Rally Gets Fresh Boost as President Named

- Smart Investor: What’s Next for Bond Yields, 40 Newly Cheap Stocks, and Tech IPOs

- Breaking Trauma Bonds & Leaving Toxic Relationships – NECN

- December 16, 2024, Birthday Forecast: A year of prosperity and meaningful bonds

- OCBC is First Bank in Singapore to Sell Tokenized Bonds

- Asia wary of Fed rate plans, China retail disappoints By Reuters

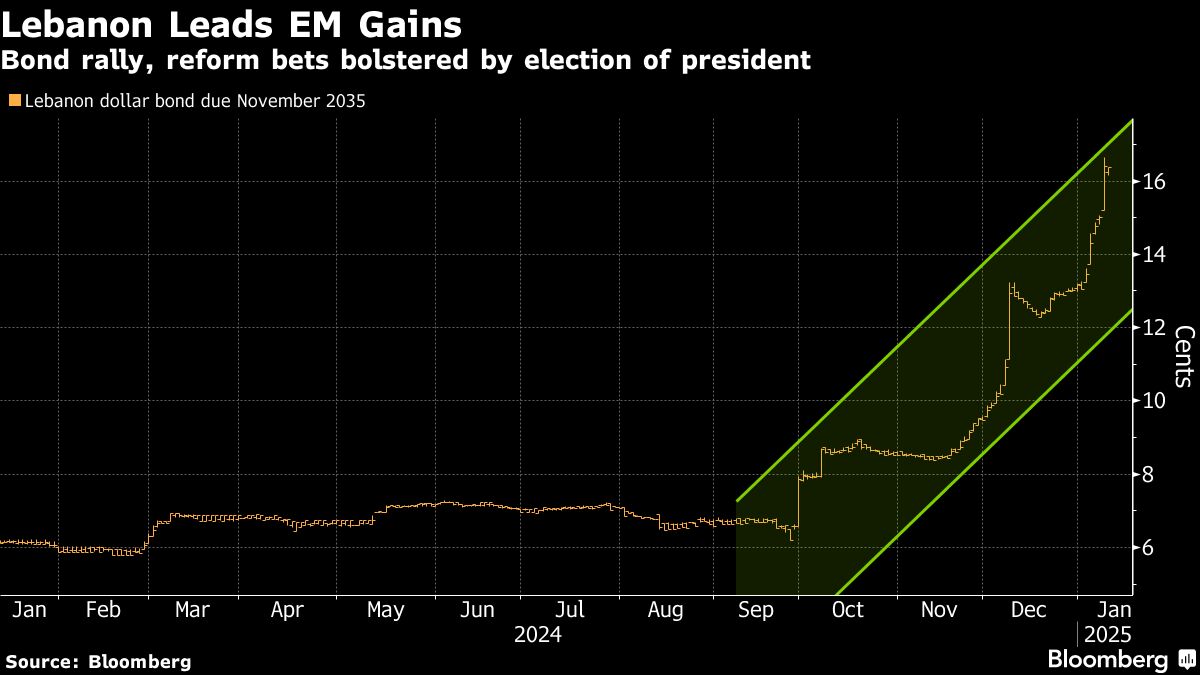

(Bloomberg) — Emerging-market money managers say it’s too early to sell Lebanon’s defaulted bonds even after they nearly tripled in value in recent months, as the appointment of a new president potentially opens the door for dollar flows, reforms and debt restructuring.

Bạn đang xem: Lebanon’s 187% Bond Rally Gets Fresh Boost as President Named

Most Read from Bloomberg

The sovereign bonds traded little changed on Friday after notching the best gains in the developing world, surging to above 16 cents on the dollar from about 6 cents in September. Danske Bank AS, Pictet Asset Management and Bank of America are now penciling a price of 20 cents, though they say the outlook beyond that will depend on success in implementing hoped-for reforms.

Lebanese bonds became popular last year among emerging-market investors who were buying up distressed debt for its high yields and idiosyncratic turnaround stories. Though the country hasn’t serviced its debt since 2020 and remains in economic paralysis, the risky trades are paying off. A ceasefire between Israel and Hezbollah in November and Thursday’s presidential election have emboldened traders to bet on a path that ultimately leads to restructuring the defaulted bonds.

“Twenty cents is a potential target if we move closer to a restructuring, so profit-taking before that level might be limited,” said Guido Chamorro, a senior EM portfolio manager at Pictet. “As long as the ceasefire holds and the president is able to appoint a prime minister quickly, bond prices still have upward potential, and investors will continue to look toward an eventual debt restructuring.”

Lebanon has faced an economic crisis since 2019 arising from years of corruption and mismanagement, pushing it to default on $30 billion of international bonds. With poverty deepening and the costs of war mounting, the country’s politicians have remained divided on the way ahead, leaving it without a president for 26 months. They also failed to carry out reforms required by the International Monetary Fund, depriving the nation of a $3 billion rescue agreed in 2022.

Xem thêm : Court Denies James Howells’ Bid for $770 Million Bitcoin Hard Drive (10/01/2025)

The appointment of army commander Joseph Aoun as president is a first step toward resolving the complex matrix of Lebanon’s problems. He’s now tasked with naming a prime minister, finance minister and central bank governor who can navigate Lebanese politics while reassuring investors and multilateral lenders.

Nguồn: https://linegraph.boats

Danh mục: News