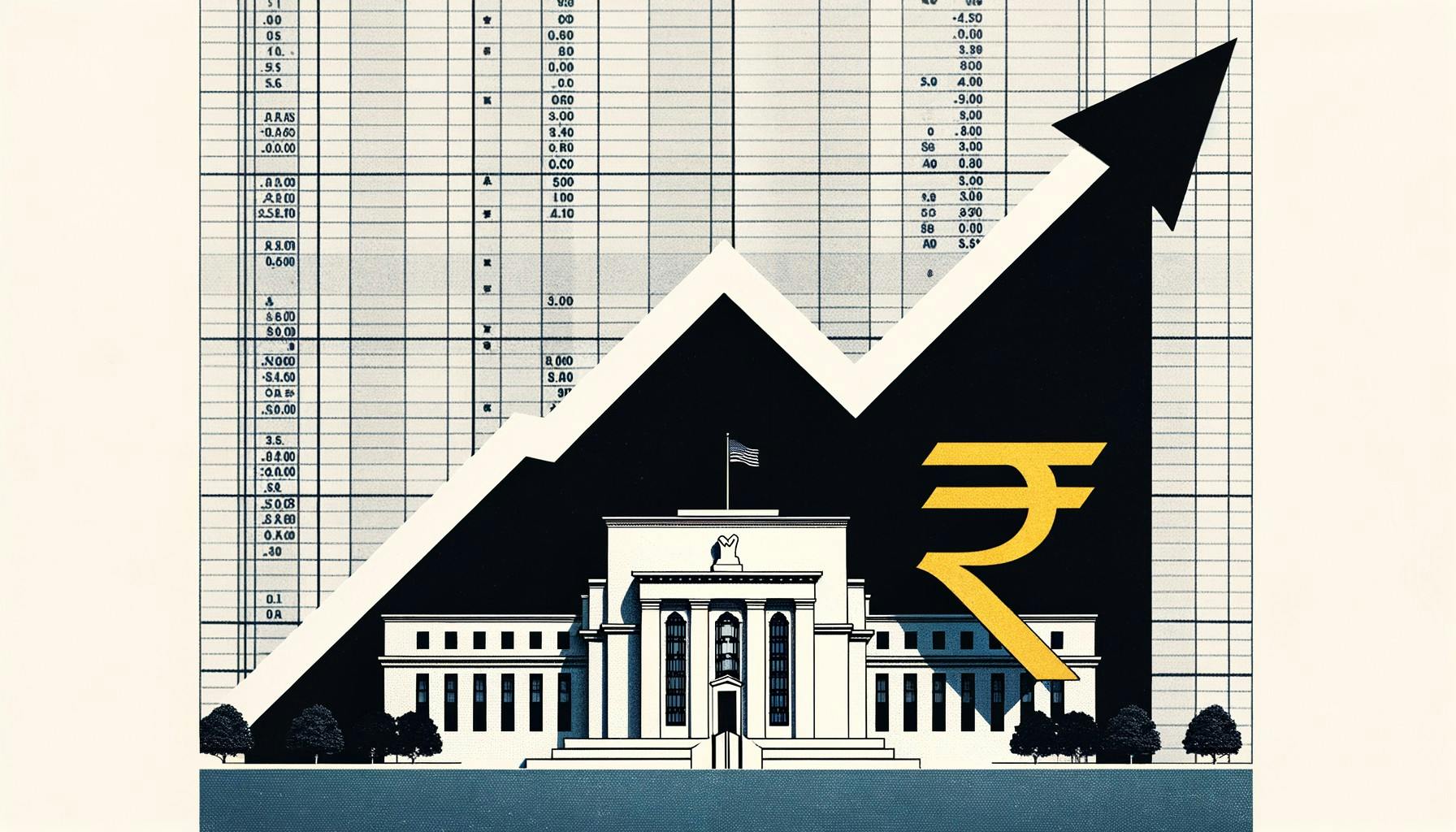

Indian Bond Yields On The Rise As US Treasuries Set The Tone

- Is OOSAX a Strong Bond Fund Right Now?

- What the bond market turmoil means for your mortgage, pension and savings | Bonds

- UK Finance Minister To Begin China Visit Amid Govt Bond Crisis

- Jackson City Council votes on bond request

- Quincy University women’s basketball trip to Hawaii strengthens bonds, creates lifetime memories

What’s going on here?

Bạn đang xem: Indian Bond Yields On The Rise As US Treasuries Set The Tone

As the year wraps up, Indian bond yields are climbing, following similar trends seen in US Treasuries, while the rupee hits new lows due to strong dollar demand.

Xem thêm : Bonds simmer as payrolls offer reality check

What does this mean?

With many trading desks operating on a skeleton crew during the holidays, Indian bond yields are set to rise, mirroring the jump in US Treasury yields. Trading activity has slowed considerably, with Indian bonds averaging just 381 billion rupees in volume recently, as reported by the Clearing Corp of India. In the US, Treasury yields are on the rise, with the 10-year nearing an eight-month peak, as investors prepare for potential interest rate changes next year. The Federal Reserve’s updated projection for a 50 basis-point rate cut in 2025 adds caution to the market, highlighted by CME’s FedWatch Tool, now showing an 89% chance of a pause in January.

Why should I care?

Xem thêm : Is PDBZX a Strong Bond Fund Right Now?

For markets: Rising yields and falling rupees.

The Indian rupee has fallen to historic lows, dropping 0.6% over the week as dollar demand spikes, influenced by maturing non-deliverable forwards and currency futures. This depreciation raises concerns over banking system liquidity. Meanwhile, Brent crude futures edged up 0.2%, now at $74.30 a barrel, following a previous session’s 1.2% gain. Market participants should watch these trends closely when assessing interest rate impacts and currency fluctuations.

The bigger picture: Global bond trends shaping local outcomes.

The movement of US bond yields is influencing Indian markets, highlighting the interconnected nature of global finance. As the Federal Reserve plans future interest rate strategies, investors worldwide are adjusting expectations, which could shift capital flows and market dynamics. With 1 US dollar now equivalent to 85.3880 Indian rupees, and in light of Fed policy forecasts, market participants need to stay updated on these international financial trends.

Nguồn: https://linegraph.boats

Danh mục: News