Bond Traders Target Deeper 2025 Fed Rate Cuts Than Market Expectations

- Indian Bond Yields Hold Steady As Traders Await New Signals

- Bonds or cash? Here is the No. 1 consideration for investors struggling to decide

- How thoughtful gifts strengthen bonds

- Ferrovial Extends Buyback While Sabadell Repays Mortgage Bonds Early

- University of Iowa seeks approval for $252.7 million hospital revenue bond sale

(Bloomberg) — Bond traders have been boosting options and futures wagers that the Federal Reserve is about to signal deeper interest-rate cuts next year than the market anticipates.

Bạn đang xem: Bond Traders Target Deeper 2025 Fed Rate Cuts Than Market Expectations

Most Read from Bloomberg

A quarter-point rate reduction is seen as practically a lock on Wednesday, so a key focus will be the Fed’s update of its quarterly projections. In September, officials’ median forecast of their policy path — dubbed the dot plot — indicated a full percentage point of total rate cuts both this year and next.

With inflation proving sticky, however, Wall Street banks have started to anticipate that the Fed will forecast perhaps one fewer cut next year, meaning three-quarters of a point in total. And some predict the central bank may pencil in just a half-point, a level that’s broadly in line with what swaps markets are pricing in.

But in interest-rate options, some traders are betting that the market’s view is too hawkish, and that the Fed will hew more closely to what it projected in September: the equivalent of four quarter-point cuts in 2025, driving the implied fed funds target rate down to 3.375%.

These traders may have in mind how potential signs of labor-market fragility could boost wagers on steeper Fed easing, and how Treasuries rallied earlier this month on data showing an unexpected jump in the jobless rate.

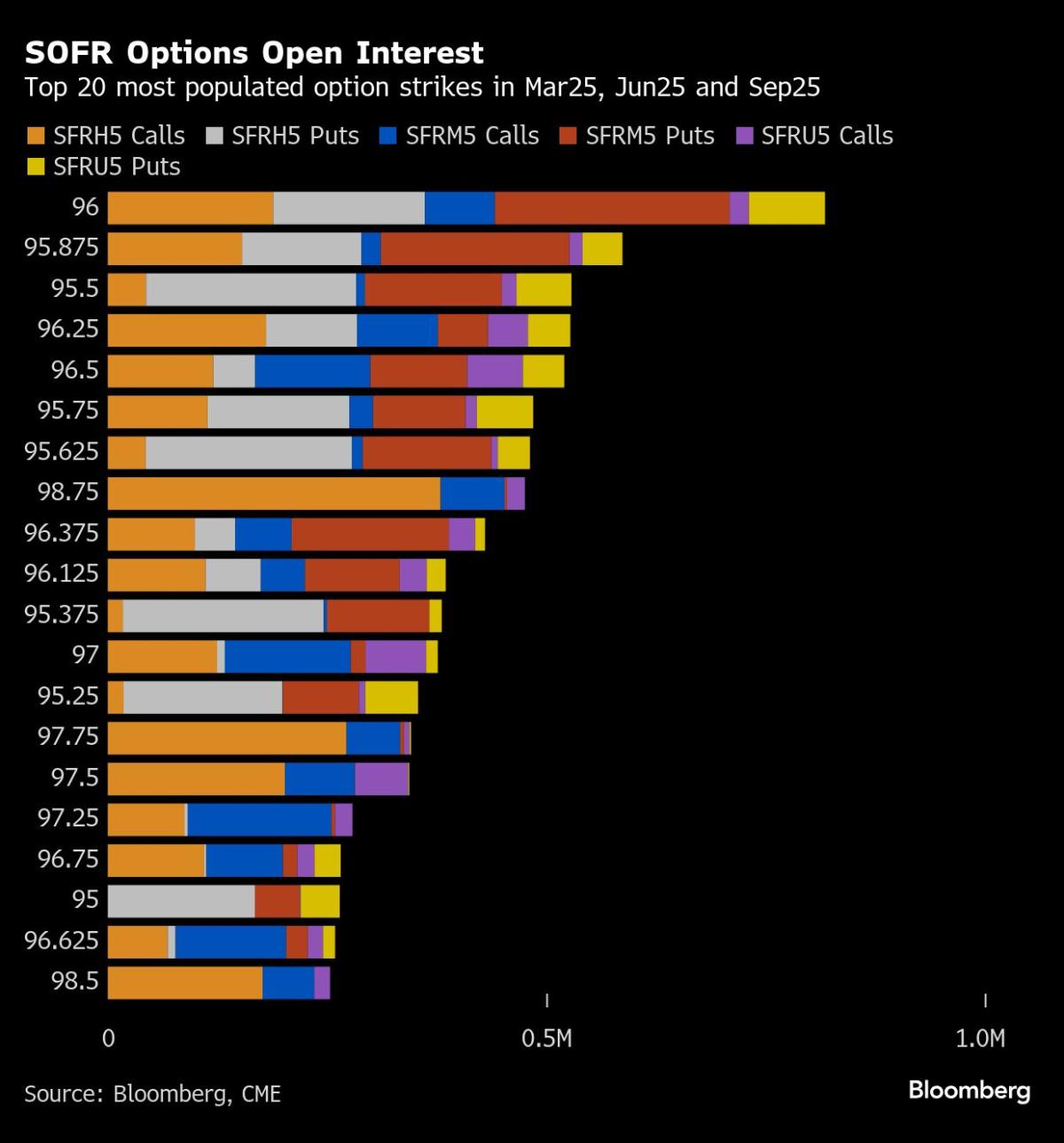

In options linked to the Secured Overnight Financing Rate, which is highly sensitive to Fed policy expectations, demand has focused on dovish bets targeting early 2026 on structures expiring early next year. These positions stand to benefit should the central bank’s policy forecasts be more dovish than markets expect.

Xem thêm : Treasuries Trade Mixed, With 30-Year Yield Near 2024 Highs

Along with this, traders are increasing positions in fed funds futures. Open interest has risen to a record in the February maturity, pricing on which is closely linked to the Fed’s December and January policy announcements. Recent flows around the tenor have skewed toward buying, indicating fresh wagers that would benefit from a December rate cut and then additional easing priced into the following decision on Jan. 29.

The bullish activity seemed to get a boost from Morgan Stanley’s buy recommendation this month on the February fed funds contract. Investors should position for a higher market-implied probability of a quarter-point cut on Jan. 29, strategists said. There’s now a roughly 10% chance priced in for such a move next month, assuming the Fed delivers what’s expected on Wednesday.

Nguồn: https://linegraph.boats

Danh mục: News