Strive Asset Management Pushes for Bitcoin Bond ETF to Democratize Crypto-Linked Investing

- ‘Bad Sisters’ perfectly captures sibling bonds and Irish gallows humor

- TBC Bank Uzbekistan Announces One of the Largest Corporate Bond Issues on Uzbekistan’s Local Market

- Ecuador Announces First Debt Conversion for Amazon Conservation

- China’s Central Bank Stops Buying Bonds as Deflation Fears Grip Economy

- DeFi descends into chaos as $1.6bn protocol changes rules of bonds backing its stablecoin – DL News

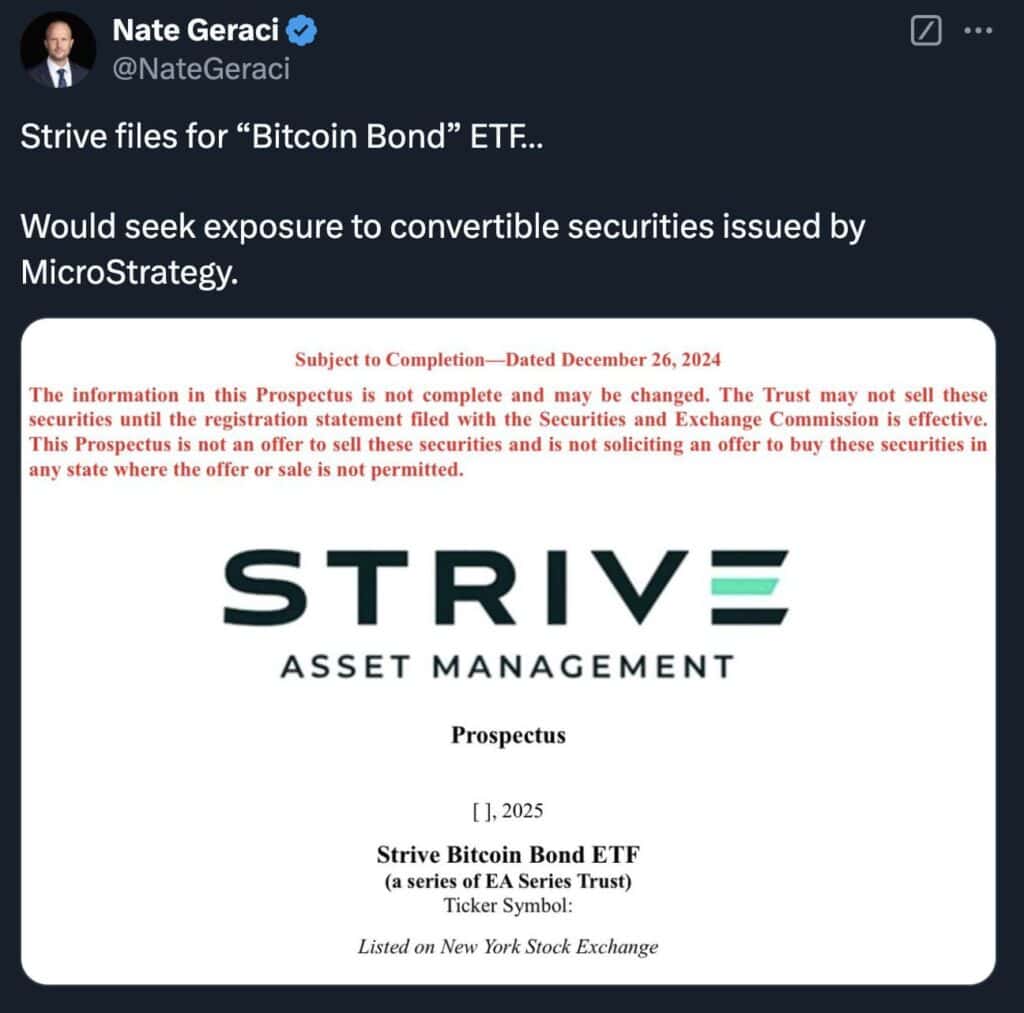

Strive Asset Management, helmed by billionaire entrepreneur and political figure Vivek Ramaswamy, has filed a proposal with the U.S. Securities and Exchange Commission (SEC) to introduce an exchange-traded fund (ETF) centered on Bitcoin-linked convertible bonds.

Bạn đang xem: Strive Asset Management Pushes for Bitcoin Bond ETF to Democratize Crypto-Linked Investing

This product, the Strive Bitcoin Bond ETF, seeks to provide retail and institutional investors simplified access to financial instruments tied to Bitcoin’s performance.

A New Approach to Bitcoin Investing

In a December 27 announcement on social platform X, Strive Asset Management shared, “Strive’s first of many planned Bitcoin solutions will democratize access to Bitcoin bonds, bringing these high-potential instruments to everyday investors.”

Source: X

Xem thêm : China Mulls Record $411 Billion Special Bonds, Reuters Says

Bitcoin bonds, issued by corporations to fund Bitcoin acquisitions, are touted for their unique risk-return profiles. However, such instruments remain largely inaccessible to average investors due to their complexity and exclusivity. Strive’s ETF aims to change this landscape, offering a streamlined path to investing in Bitcoin-related financial products.

The ETF will focus on securities from companies like MicroStrategy, a corporate Bitcoin pioneer. Under the leadership of Executive Chairman Michael Saylor, MicroStrategy has purchased approximately $27 billion worth of Bitcoin since 2020. These acquisitions were financed using equity raises and convertible bonds—debt instruments that can later be exchanged for equity under specific terms.

Source: X

How the ETF Will Work

According to the SEC filing, the Strive Bitcoin Bond ETF will be actively managed and seek exposure to Bitcoin-linked bonds through direct investments or derivatives such as swaps and options. To ensure liquidity and collateralization, the fund will also hold high-quality short-term assets like U.S. Treasuries and money market instruments.

Xem thêm : BlackRock ETF Buys First Muni Bonds Issued Through Blockchain

While the ETF’s management fees have not been disclosed, actively managed funds often carry higher expense ratios compared to passive ETFs. The added cost reflects the expertise required to navigate the complexities of Bitcoin bonds and related derivatives.

Strive’s Strategic Vision

Founded in 2022, Strive Asset Management has positioned itself as a forward-looking investment firm tackling global economic challenges, including inflation, debt crises, and geopolitical risks. The firm views Bitcoin as a strategic hedge against these pressures, describing it as “the most compelling long-term investment for risk mitigation.”

Strive’s latest ETF initiative aligns with its broader mission to promote Bitcoin adoption within diversified portfolios. By simplifying access to Bitcoin bonds, the firm seeks to encourage both retail and institutional investors to consider the cryptocurrency as a foundational component of their financial strategies.

The Bigger Picture: Ramaswamy’s Leadership

Ramaswamy, known for his capitalist approach to problem-solving, has leveraged his platform as a business leader and political figure to promote innovative financial solutions. While his 2023 presidential campaign ended with an endorsement of Donald Trump, Ramaswamy’s influence expanded through his appointment as co-lead of the Department of Government Efficiency (D.O.G.E.), a Trump administration initiative focused on reducing government waste, alongside tech mogul Elon Musk.

Strive’s Bitcoin Bond ETF represents yet another step in Ramaswamy’s mission to reshape the financial and political landscapes, offering investors a unique opportunity to engage with the evolving cryptocurrency market.

Nguồn: https://linegraph.boats

Danh mục: News