China Mulls Record $411 Billion Special Bonds, Reuters Says

- Stock and Share Market News, Economy and Finance News, Sensex, Nifty, Global Market, NSE, BSE Live IPO News

- Santa packed it up, bell bottoms make a comeback, and bonds play scrooge

- Time to go green? Process vs outcome – and what bonds are best for you

- Indian Bond Yields Stay Steady As Traders Await Guidance

- US Fed Moves Set Indian Bond Yields On Edge

(Bloomberg) — China’s policymakers plan to sell a record 3 trillion yuan ($411 billion) of special treasury bonds in 2025, Reuters reported Tuesday, as the government seeks to boost the slowing economy.

Bạn đang xem: China Mulls Record $411 Billion Special Bonds, Reuters Says

Most Read from Bloomberg

Funds raised from the bonds will be used to support consumption subsidies, business equipment upgrades as well as investments in key technology and advanced manufacturing sectors, according to Reuters, which cited two unnamed sources. Some of the proceeds will also be used to inject capital into large state banks, it said.

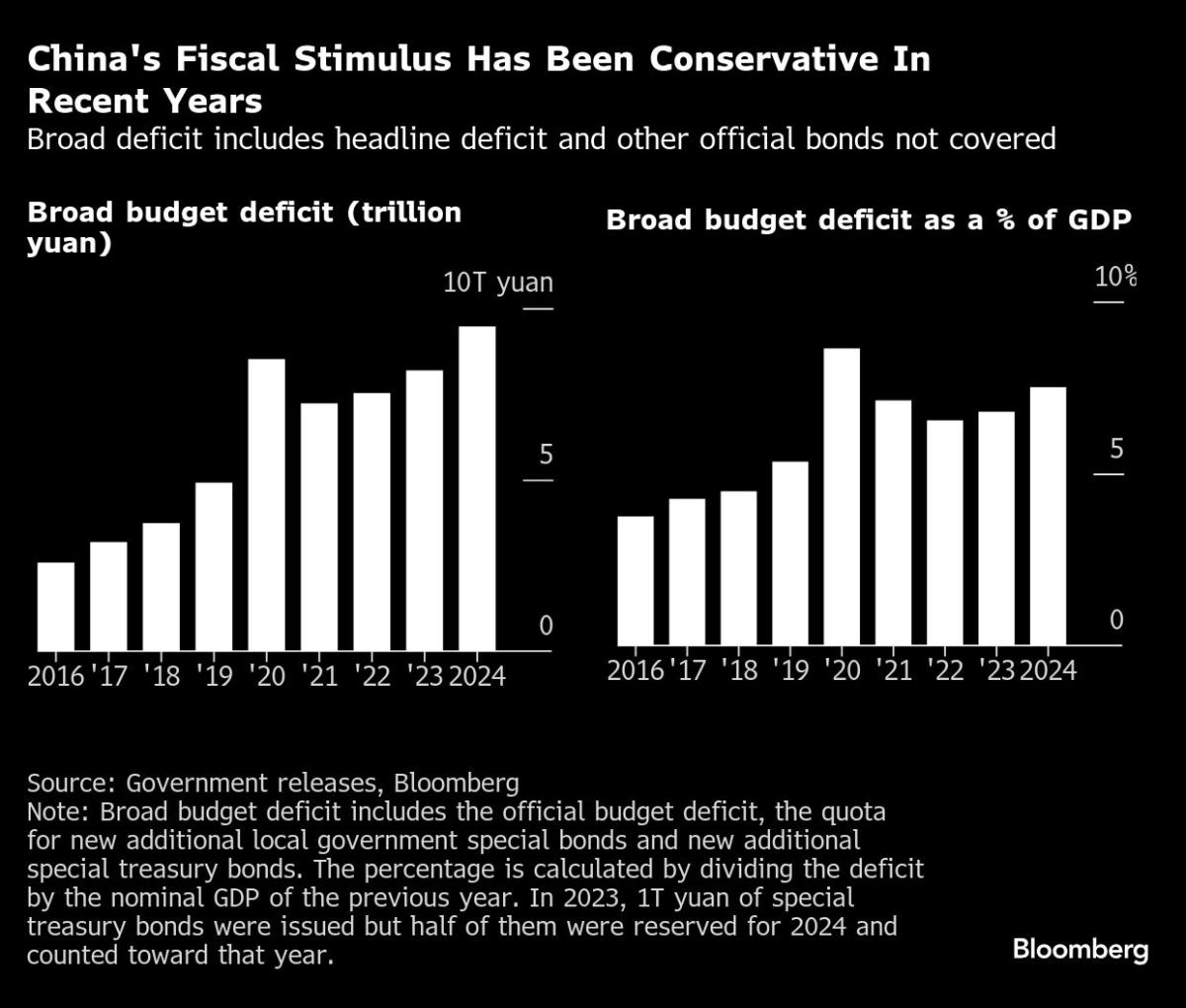

Greater fiscal stimulus would help the world’s second-largest economy buffer against expected headwinds from the incoming Trump administration, which has threatened to impose steep tariffs on Chinese imports. China’s top leaders have vowed to expand the headline deficit as well as various bond sales to support growth next year, with greater focus placed on boosting consumption.

Xem thêm : Why bond yields are signaling trouble ahead for the stock market

China’s CSI 300 equity benchmark gained about 1% after the report, before paring gains. Chinese government bonds extended losses, with the 10-year yield rising four basis points to 1.72% from a record-low close in the previous session.

China’s special sovereign bonds are issued for specific purposes — such as financing pandemic-related spending — and therefore are not counted toward the headline budget deficit. The size of the potential bond sales would exceed the 1 trillion yuan sold this year and become the highest on record.

“It’s bigger than our expectations and shows the government’s willingness to shore up growth through a more sizable fiscal stimulus,” Michelle Lam, Greater China economist at Societe Generale SA, said of the reported plan.

About 1.3 trillion yuan of the funds to be raised will be used to support a consumer product and business equipment trade-in program, as well as major construction projects, according to Reuters.

Apart from that, more than 1 trillion yuan will be used to invest in “new productive forces,” which stand for advanced manufacturing sectors such as electric vehicles, the Reuters report cited an unnamed source as saying.

Xem thêm : GAINI: A 7.875% Baby Bond IPO From Gladstone Investment Corporation (NASDAQ:GAIN)

The rest of the funds will be used to recapitalize large state banks as they’re suffering from narrowing profit margins, according to the report.

–With assistance from Wenjin Lv, Josh Xiao and Abhishek Vishnoi.

Nguồn: https://linegraph.boats

Danh mục: News